We wanted to take a look at how DOH Medical Sales products have performed this summer. Does the value proposition made to patients via DOH Compliant products also translate to a meaningful revenue incentive for Brands providing those products? To examine this, we connected with our friends at Headset.io (and also utilized public data from CCRS) to get a feel for the numbers.

“If it doesn’t make dollars, it doesn’t make sense.”

Market Share for DOH Medical Sales

DOH Medical Sales have skyrocketed in recent months. According to CCRS records, there were only 34 DOH Compliance samples statewide in the month of March. In July, that number ballooned to 1,561. That’s a 4,500% increase! 60% of all DOH Compliance tests submitted to CCRS in the month of July were from brands participating in the Certified With Confidence™ Program.

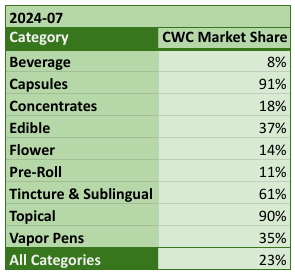

Our friends at Headset helped us gather data related to Brands enrolled in the Certified With Confidence (CWC) Program, specifically looking at market share by category . Those Brands enrolled in the program command a respectable 23% of the entire I-502 market, based on retail sales data. Some product categories (like Capsules and Topicals) are almost completely owned by CWC participating Brands.

Our friends at Headset helped us gather data related to Brands enrolled in the Certified With Confidence (CWC) Program, specifically looking at market share by category . Those Brands enrolled in the program command a respectable 23% of the entire I-502 market, based on retail sales data. Some product categories (like Capsules and Topicals) are almost completely owned by CWC participating Brands.

Price Advantage for DOH Medical Sales

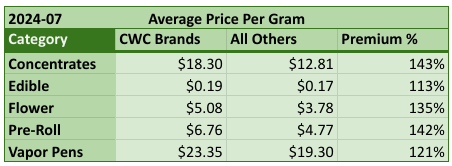

We also looked at the data to get a feel for how products sold by CWC participating Brands may enjoy a price advantage at retail. Within the five most popular product categories, products sold by Brands participating in the CWC Program earn themselves a noticeable price premium, selling for 13% more on average for Edibles all the way up to 43% more for Concentrates. These figures are based on the average retail sale price, including discounts, not including taxes.

*figures represent average pre-tax retail price per gram of product net weight except for Edibles where the figures listed are average price per milligram of THC.

Of course, the price premium comes with a cost: it costs more for producers to get products tested to DOH Medical Grade standards vs regular I-502 compliance standards. Nonetheless, a breakdown of the numbers shows that the cost of the test pales in comparison to the premium enjoyed by the products.

Take Flower for example. If we assume a 15 lb lot size, the additional cost of testing to achieve DOH Compliance is $0.01 per gram ($70 add-on for the HM test divided by 6,804 grams in 15 lbs). That means the additional cost of testing in this scenario is just one penny per gram of Flower — less if the lot size is larger — and on average it translates to a $1.30 per gram premium on the retail shelf. The cost of testing is far outweighed by the additional gross revenue.

Take Concentrates as another example. If we assume a one kilo batch size, the additional cost of testing to certify that batch as DOH Compliant is $0.07 per gram ($70 divided by 1,000 grams), and on average translates to a $5.49 premium on the retail shelf. Again, an enormous revenue advantage compared to the associated cost.

What’s Next?

Certainly, the brands participating in the CWC Program enjoy their price premiums and market share for reasons beyond their participation in the program. In fact, participation in CWC is just one of many ways that premium brands demonstrate their earned reputation for quality. At Confidence, we are proud to partner with industry members working to go the extra mile for Washington consumers, and we do what we can to enhance their visibility and sales.

Thanks to Headset.io, we’ve shown one side of the market’s coin. Next, we are working to identify the other side: patient purchasing behavior. How often are DOH products sold with a tax exemption to patients, and has the new tax incentive increased the overall pre-tax retail sales in the market? If you have insights on this topic, we’d love to hear from you about it.

While we continue this important work, one thing is certain: patients seeking Medical Grade products – whether or not they hold a medical card – now have access to a much larger range of brands, product types, and overall variety than they have enjoyed recently.

Call or write to us at: 206-743-8843, info@conflabs.com